East vs. West Wax Battle: African Midstream

Waxing Lyrical about Pipelines - East Coast vs. West Coast (Central Africa)

Nearly 20 years ago, I began my career in flow assurance engineering with the Addax Petroleum (now Sinopec) Rabi Pipeline Waxing Potential Study. This initial project highlighted the significant challenges posed by wax deposition in pipelines, which affect crucial parameters like pressure drop, pipeline integrity, and overall flow. Understanding the conditions that lead to wax and gel formation provides valuable insights for operators in managing these issues. My passion for energy access, especially in Africa, has been evident in my writings, articles, and conference presentations. Midstream pipelines are critical in addressing the continent's energy poverty challenge, but when it comes to wax in these very long lines gelling and wax deposition can result in a significant obstacle to the smooth operation of inter-country pipelines. Gelling of the waxy crudes become an issue once flow stops and the wax drops out and causes a gel to form. This gel can then be very difficult to restart in these long lines as the pressure needed can exceed the design pressure of the pipelines. Therefore, to prevent this from happening you have one of four options options:

Actively heat the pipelines to keep the oil warm so it doesn’t gel

Displace the oil from the pipeline with an inert fluid such as water. Some lines are so long that this isn’t possible.

Inject large volumes of PPD to prevent the oil from gelling. Unfortunately this doesn’t always work and costs large amounts of money.

Somehow keep the oil moving so it doesn’t gel. Not easy if you have lost power to your system

As for wax deposition I think we can say that is the lesser of two evils as you can manage that by pigging but even then there are problems.

For someone like me who’s in love with Dunkin Donuts, the idea of wax deposition in pipelines frightens me. You can see the comparison below and see which you would rather have.

This article is the second installment in Pontem Analytics' August 2024 series on wax and wax management, focusing on the technical challenges faced by several African midstream oil pipelines, focusing on:

East African Crude Oil Pipeline (EACOP - East Coast)

Chad-Cameroon Pipeline (COTCO - West/Central Coast)

Wax deposition in these long-distance pipelines is a continuous problem that needs managed because it affects flow efficiency, maintenance, and overall pipeline integrity, if left unchecked. Whereas for gelling this is only a problem when the system shuts down and the crude is allowed to cool to ambient conditions.

For wax deposition the buildup of wax restricts the flow area, increases friction, and necessitates higher pumping pressures to maintain throughput. This results in higher maintenance requirements, with regular pigging operations needed to clear wax deposits—an expensive and time-consuming process. Additionally, wax buildup can lead to uneven stress distribution in the pipeline, potentially causing mechanical failures or leaks. Managing wax also involves keeping the oil temperature above the Wax Appearance Temperature (WAT), which requires additional heating infrastructure and increases operational costs.

For gelling if it is allowed to happen you end up with a wax candle that is 100’s of kilometres long that means you cannot restart your pipeline.

The preceding article, "Writing the Book on Wax," featured Tommy Golczynski's insights into wax, providing an introduction to the topic.

Future articles in this series will delve into specific areas such as wax issues in African midstream pipelines, case studies from other regions, a wax quiz, and laboratory testing aspects. I invite you all to stay tuned throughout August 2024 as we explore the complexities of wax management.

It’s getting hot in here!

While the topic of wax is getting hot in Africa, wax and gel formation occurs at colder temperatures under what is known as Wax Appearance Temperature (WAT) and Pour Point (PP) for gelling. The WAT is the critical threshold at which paraffin waxes begin to crystallize out of crude oil as it cools. This temperature varies depending on the composition of the crude oil, with higher paraffin content generally leading to higher WATs. For African crude oils, WATs typically range from 25°C to 50°C, though this can vary based on the specific crude blend.

The PP of the oil is where it goes from being a liquid to a solid. Once it is a solid it can be very difficult to get it moving again.

Maintaining pipeline temperatures above the WAT and/or PP is crucial to preventing wax deposition and gelling, ensuring efficient and uninterrupted oil flow.

In essence, it’s getting hot in here, but you don’t need to take anything off. Rather you might want to consider insulation.

Temitope Solanke

To get more information on other wax aspects such as pour point, gelation and temperature gradient, etc., that would provide better understanding of waxing deposition. Pete Conrad’s article below gives a good overview of wax deposition.

Waxing Lyrical - East Coast vs. West Coast (Central Africa) Pipeline Battle

When it comes to the oil industry, there's a not-so-glamorous villain lurking in the depths of long midstream pipelines—wax / gel management. Just like the infamous East Coast-West Coast rap feud of the '90s, pipelines in Africa have their own epic battles. On the East Coast, we have the East African Crude Oil Pipeline (EACOP), while to the west of it boasts the Chad-Cameroon Pipeline (COTCO), albeit in Central Africa. But unlike Tupac and Biggie, our adversary here is wax, and trust me, it's not dropping any hot tracks.

In Africa, wax / gel management has been a persistent issue, exacerbated by the continent's varied climatic conditions and challenging geographical landscapes. Many of the continent's inter-country pipelines, such as the East African Crude Oil Pipeline (EACOP) and the Chad-Cameroon Pipeline (COTCO), traverse regions with significant temperature fluctuations, which can accelerate wax / gel formation. The remoteness of these pipelines further complicates maintenance efforts, making it difficult to implement regular pigging operations or deploy heating solutions to prevent wax gelling. Additionally, the high cost of advanced technologies needed to mitigate wax / gel and limited access to such technologies in some African regions have made managing this issue particularly challenging. As a result, wax management has increased operational costs and posed significant risks to the reliability and safety of the continent's critical energy infrastructure, acting as a persistent plague on Africa's oil transport systems.

Let's dive into these iconic pipelines and see how they handle their wax woes.

East African Crude Oil Pipeline (EACOP)

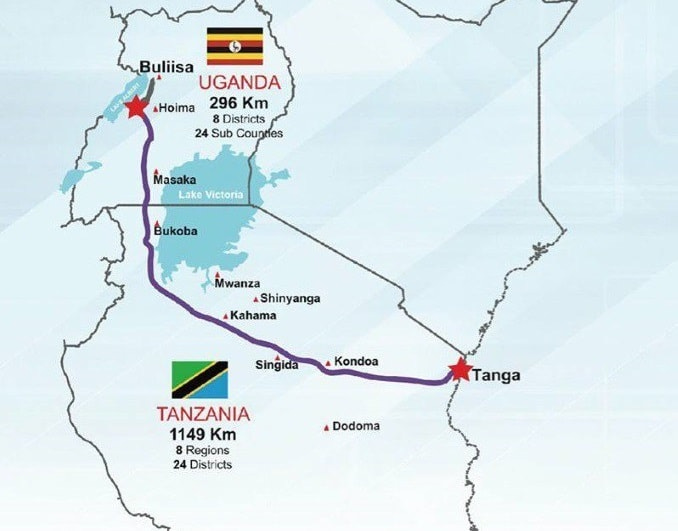

Representing the East Coast, The East African Crude Oil Pipeline (EACOP) is a critical infrastructure project designed to transport crude oil from the oil fields of Uganda to the port of Tanga in Tanzania, covering approximately 1,443 kilometers. This pipeline is vital for East Africa's economic development, providing a much-needed route for landlocked Uganda to access international markets. By facilitating the export of Ugandan crude oil, the EACOP is expected to generate significant revenue, boost economic growth, and create job opportunities in the region. Additionally, the pipeline is a strategic asset for regional energy security and integration, potentially paving the way for further energy infrastructure development in East Africa.

One of the primary technical challenges faced in the design and operation of the EACOP is managing wax / gels due to the paraffinic nature of the Ugandan crude oil. The crude oil produced in Uganda is characterized by a relatively high wax content, with a Wax Appearance Temperature (WAT) in the region of >50°C. This high WAT poses a significant challenge as the pipeline traverses varied terrains and climates, including high-altitude areas where temperatures drop significantly, especially at night. Such conditions increase the likelihood of the oil cooling below the WAT and PP, leading to wax crystallization and deposition on the pipeline walls and when the pipeline stops flowing, gelling. The challenges are summarized below:

Tropical Climate: Despite being in a warmer region, the elevation changes and nighttime temperatures can cause significant oil cooling, leading to wax deposition and/or gelling.

Remote Areas: The pipeline traverses remote and ecologically sensitive areas, making maintenance operations more challenging and costly.

Temperature Management: Maintaining the oil temperature above the WAT / PP throughout the entire pipeline length requires sophisticated heating systems.

To address these wax-related challenges, several considerations were incorporated into the EACOP's design.

Firstly, thermal insulation is employed along sections of the pipeline to minimize heat loss and maintain the crude oil temperature at as high a temperature as feasible, thus minimizing wax deposition and increasing the time before gelling occurs after flow stops. Additionally, the pipeline design includes provisions for periodic pigging operations, which involve sending cleaning devices, known as pigs, through the pipeline to remove accumulated wax and other deposits. Another critical consideration is the use of trace heating systems, which provide localized heating in specific sections of the pipeline where the risk of temperature drop is particularly high. This helps maintain the oil's temperature and viscosity, ensuring a smooth flow and preventing gelation.

Despite these measures, the EACOP faces ongoing challenges related to wax management. The remote and ecologically sensitive areas the pipeline traverses complicate maintenance and emergency response efforts. Furthermore, the high cost and logistical complexity of implementing advanced wax mitigation technologies in such regions present additional hurdles. Continuous monitoring and adaptive management strategies are essential to address these challenges, ensuring the pipeline's operational efficiency and safety. Overall, the EACOP's successful operation hinges on effectively managing the wax content of the transported crude oil, making it a key focus of the pipeline's design and operational protocols.

The Ugandan Context

Uganda's oil and gas industry is a promising catalyst for economic growth, with estimated reserves of over 6.5 billion barrels of oil and significant natural gas deposits. Key projects include Tilenga (operated by TotalEnergies), Kingfisher (operated by CNOOC), and the East African Crude Oil Pipeline (EACOP). These initiatives aim to harness Uganda's resources, drive infrastructure development, and support projects like refineries, pipeline networks, and new transportation infrastructure, such as the airport in Hoima.

The oil and gas sector's strategic importance lies in its potential to diversify Uganda's economy, traditionally reliant on agriculture. By reducing import dependence, creating jobs, and generating revenue, the sector can fund public services and uplift millions from poverty. Additionally, the government prioritizes local content development, aiming to involve local businesses and communities in the industry's value chain through partnerships with international oil companies. This approach fosters skills development, technology transfer, and entrepreneurship, promoting inclusive growth and sustainable development.

Pontem Analytics as a viable partner in East Africa’s efforts to manage flow assurance challenges

Understanding the issue of energy poverty in Africa, Pontem Analytics has actively engaged the East African energy companies and forged partnerships required to support the key oil and gas infrastructure in Uganda and the inter-country EACOP project.

Pontem Analytics sponsored and participated in the 8th Uganda International Oil & Gas Summit at Serena Hotel Kampala, alongside EACOP, TotalEnergies, and CNOOC. The event, opened by Prime Minister Robinah Nabbanja, focused on Uganda's oil and gas developments, including the Kingfisher and Tilenga fields and the East African Crude Oil Pipeline. Pontem emphasized the importance of strategic partnerships and data-driven approaches in advancing Uganda's energy sector.

The Chosen partner organization in the NEC(k) of Uganda (the woods)

Selecting a partner organization with a robust presence in Uganda's engineering and business sectors was crucial, particularly one recognized by major players in the oil and gas industry. Following extensive consultations with oil and gas experts and business consultants in Uganda, we identified the National Enterprise Corporation (NEC) as our top choice. The following section provides an overview of NEC and its role within the industry.

Partnership talks commenced in February 2024 during Nigeria's PETAN’s Sub-Saharan Africa International Petroleum Exhibition and Conference (SAIPEC), where a Ugandan delegation, including members from the Petroleum Authority of Uganda (PAU), Ugandan National Oil Company (UNOC), and independent consultants, participated. Subsequently, engagement with NEC began through stakeholder discussions, leading to productive talks. The following month, I visited Uganda to further solidify the partnership discussions and proposals with NEC's leadership. During this visit, I had the privilege of meeting with NEC's CEO, General Mugira, who expressed a warm welcome and articulated clear objectives for the partnership. We mutually agreed that a significant aspect of the potential collaboration would focus on local human capital development, fostering work associations, and providing training for the local workforce.

Following a fruitful discussion with General Mugira, both entities are progressing towards finalizing a partnership, with engagement from the leadership of UNOC and PAU in the concluding phases. Pontem eagerly anticipates collaborating with NEC to bolster the oil and gas sector through production assurance engineering and fostering a future-ready workforce in data analytics and digitalization. Stay tuned for further updates on this endeavor.

Chad-Cameroon Pipeline (COTCO)

On the West Coast of the EACOP pipeline, the Chad-Cameroon Pipeline (COTCO) serves as a vital conduit for transporting crude oil from the oil fields in Chad to the export terminal off the coast of Cameroon. This 1,084-kilometer pipeline not only enables landlocked Chad to access international oil markets but also plays a significant role in the economic development of both countries. Initially designed to handle 250,000 barrels per day of heavy crude from the Doba fields, the pipeline's operation has become increasingly complex due to introducing high-viscosity, wax-rich crude oil from new shippers. This shift has resulted in increased operational requirements to manage the extra wax being produced such as increased wax volumes being removed from the pipeline.

Wax deposition poses a critical challenge and is currently well managed by an effective pigging program but there are increasing concerns with gelling in the subsea part of the pipeline that see some of the coldest temperatures.

There is also work planned to better manage the parts of the COTCO system that cannot be pigged. These include various process piping and instrumentation throughout the system, which are more difficult to clean and maintain.

To address these challenges, COTCO has a number of options to evaluate to minimize the impact of the extra wax being produced. These include

Installing Electrical Heat Tracing (EHT) systems

Chemical solvent treatments

Improved operational procedures to displace the lines at risk with an inert fluid before gelling occurs

If deposited wax or gels need to be remove options to manage this include heated blankets and steam lances.

COTCO's continuous efforts to manage the increasing wax content are crucial as the proportion of waxy crude oil transported through the pipeline is expected to rise further. Ensuring the efficiency and safety of the pipeline's operations requires innovative solutions and regular maintenance to combat the persistent issue of wax deposition.

With new third-party entrants with high wax content entering the COTCO pipeline, it is important to monitor the impact of fluctuating rates from third-party pipelines into the main COTCO pipeline and provide insights on how these variations affect operations.

The challenges are summarized below:

Varying Terrain: The pipeline passes through diverse terrains, including deserts, savannas, and rainforests, each with its temperature profiles that affect wax deposition.

Operational Complexity: The varying altitudes and climates require complex operational strategies to prevent wax buildup.

Environmental Concerns: Similar to EACOP, the pipeline's route through environmentally sensitive areas adds complexity to maintenance and emergency response efforts.

Varying and increasing production from high wax content entrants into the pipeline

The Cameroon Context

Cameroon plays a pivotal role in Central Africa's oil and gas sector, contributing significantly to the region's energy landscape. The country's oil production, primarily offshore, forms a substantial part of its economy, providing valuable export revenue and energy resources. The presence of the COTCO pipeline enhances Cameroon's strategic importance by enabling the transit of Chadian crude oil to international markets. This pipeline strengthens its position as a key energy hub in the region.

Looking ahead, Cameroon is exploring potential joint projects with neighboring Equatorial Guinea to further develop the region's oil and gas infrastructure. Such collaborations aim to enhance resource sharing, improve energy security, and maximize the utilization of regional hydrocarbon resources. These initiatives could include the development of shared processing facilities, cross-border pipelines, and integrated export strategies. By working together, Cameroon and Equatorial Guinea can leverage their combined resources to attract investment, boost production capabilities, and strengthen their positions in the global energy market.

Pontem Analytics as a viable partner in West / Central Africa’s efforts to manage flow assurance challenges

Pontem Analytics has been actively engaging regions in the West of the East African oil and gas industry. These include Central and West Africa. I have written about Pontem’s strides in West Africa in the two articles below, so I will focus on Central Africa – Cameroon.

Engaging and starting a journey of collaboration with COTCO and other operators in Cameroon, such as Addax Petroleum (Sinopec) and Perenco, etc., is important to support the Central African market. Tommy Golczynski and I visited Cameroon in July 2024 to begin the engagement and collaboration efforts in Central Africa. Having said that, Pontem and team members have already been involved in several projects in Equatorial Guinea, working with clients such as Chevron (Noble Energy) on the Alen Gas Monetization project and other new tiebacks and Marathon Alba on metering engineering support. This is relevant due to the ongoing efforts in developing a pipeline from Equatorial Guinea to Cameroon.

Tommy and I visited the COTCO office in Douala to meet with the Chad-Cameroon Pipeline operations team. We discussed areas of collaboration on the main issue facing the project, which is wax management. Stephen Hamilton, Pontem Analytics’ Production Chemistry Technical Authority, joined the meeting and shared his 5 cents on how we can support COTCO on the wax issues. Stephen comes with a wealth of experience and history on the Chad-Cameroon pipeline from his time as the Head of Flow Assurance for Savannah Energy, who was a partner on the project. His previous visit to the sites in Cameroon and his earlier involvement in scoping out wax studies proved valuable and helped demonstrate the value we can offer.

Conclusion

In summary, managing wax / gels in inter-country midstream oil pipelines is a significant challenge for Africa's oil and gas sector. The East African Crude Oil Pipeline (EACOP) and the Chad-Cameroon Pipeline (COTCO) are crucial infrastructures facing similar technical issues related to wax / gels. This phenomenon hampers flow efficiency, increases maintenance costs, and poses risks to pipeline integrity. Effective management of these issues is vital to ensure crude oil's safe and efficient transportation, especially given the diverse climates and terrains these pipelines traverse.

As the industry grapples with these challenges, the need for innovative solutions and strategic partnerships becomes increasingly apparent. Collaborations, such as those involving flow assurance and wax management experts like Pontem Analytics, aim to address wax management and enhance flow assurance of the pipelines. These efforts not only support the operational stability of vital pipelines but also contribute to the region's broader goals of economic development and energy security. The successful mitigation of wax-related issues is key to maximizing the potential of Africa's oil and gas resources and ensuring sustainable growth in the energy sector.

In the grand arena of midstream oil transportation, wax deposition remains a formidable foe. The East Coast's EACOP and the West Coast's COTCO pipelines have unique strategies to combat this insidious problem. Whether it's the tropical climates of East Africa or the varied terrains of Central Africa, the battle against wax is relentless. And just like the legendary rap battles, the quest for pipeline efficiency and reliability continues, with each pipeline striving to keep the flow smooth and uninterrupted, avoiding any "sticky" situations.