Recap of SPE Ghana’s Biennial International Summit and Exhibition (GH-BISE)

Theme - Embracing Innovation: Redefining the Future of the Oil & Gas Industry in Africa

The Society of Petroleum Engineers (SPE) Ghana Section held the second edition of its Ghana Biennial International Summit and Exhibition at the Alisa Hotel North Ridge, Accra, from May 19th to 21st, 2024. This prestigious event attracted industry leaders from across Africa and beyond, providing a platform for discussing transformative strategies in the oil and gas sector. I had the honor of being invited by SPE Ghana to participate in a panel session hosted by the SPE Data Science and Engineering Analytics Technical Section (SPE – DSEATS), centered on the theme "Transformative Strategies for the Future: Infusing AI into African Oil and Gas Operations."

The summit covered a wide range of topics, so I will break down the key highlights into different sections. This will include a summary of the overall summit, discussions on keynote speeches and emerging trends, insights from my panel session, and other areas of interest explored during the event.

Recap of Keynote Speech by Dr Ben Asante, the CEO of Ghana National Gas Corporation (GNGC)

The CEO of GNGC gave an insightful keynote speech highlighting the challenges in the development and utilization of energy resources in Africa and recommended a development framework for Africa’s energy sector. As part of this discussion, he addressed the delivered gas pricing equation and commodity pricing models and advocated for a segregated market model over an integrated market model. In light of Ghana’s efforts to reduce carbon emissions, he presented a case study on how GNPC reduced emissions by 7 million tons of CO2 per year.

Challenges in the development and utilization of energy resources in Africa

Dr. Asante highlighted several challenges in the development and utilization of energy resources in Africa, each presenting significant hurdles that require comprehensive solutions to overcome.

Firstly, the lack of access to capital for projects remains a fundamental obstacle. Energy projects, particularly in the oil and gas sector, require substantial investments. African countries often struggle to attract sufficient financing due to perceived risks associated with political instability, economic volatility, and inadequate legal protections for investors. This financial shortfall hampers the ability to initiate and sustain large-scale energy projects, leading to underdeveloped infrastructure and suboptimal resource utilization.

Moreover, the inadequacy of requisite infrastructure is another critical issue. Many African nations lack the necessary infrastructure to support efficient energy production and distribution. This includes pipelines, refineries, power plants, and transportation networks. Without this infrastructure, even the most resource-rich areas cannot fully exploit their energy potential, resulting in energy shortages and inefficiencies that stifle economic growth and development.

The fiscal regime and taxation requirements in many African countries are often unattractive to foreign investors. High taxes, complex regulatory requirements, and the absence of incentives make investment in the energy sector less appealing. This fiscal environment deters potential investors who might otherwise bring in the capital and expertise needed to develop energy resources effectively.

Compounding these challenges is an unclear institutional and regulatory framework. Regulatory uncertainty can deter investment and development, as companies are hesitant to commit resources to projects where the rules may change unexpectedly. A stable, transparent, and predictable regulatory environment is essential for attracting and retaining investment in the energy sector.

There is also a significant shortage of requisite intellectual capacity. The development and management of energy resources require highly specialized knowledge and skills. However, many African countries face a dearth of qualified professionals in fields such as geology, engineering, and environmental science. This skills gap limits the ability to efficiently develop and manage energy projects and hinders the transfer of technology and expertise from more developed regions.

Inadequate local and private sector participation in the energy sector exacerbates these issues. Local businesses and private enterprises often lack the resources or capabilities to compete with multinational corporations. This lack of participation can lead to a reliance on foreign entities, which may not prioritize local development or capacity building, resulting in less sustainable and inclusive growth.

Another problem is the non-cost-reflective pricing of delivered commodities. Many African countries subsidize energy prices to make them affordable for their populations. While well-intentioned, these subsidies often lead to financial losses for energy providers, discouraging investment and reducing the funds available for the maintenance and expansion of energy infrastructure.

Inter-sectorial debt between public entities also poses a significant challenge. Debts accrued between different government departments and state-owned enterprises can lead to cash flow problems and financial instability. This debt can delay or halt energy projects, further compounding the infrastructure and investment challenges.

Lastly, imprudent management of resource revenues is a pervasive issue. Mismanagement and corruption can divert funds away from essential development projects and into the hands of a few individuals. Proper governance and transparent management of resource revenues are crucial to ensure that the wealth generated from energy resources benefits the broader population and contributes to sustainable economic development.

Dr. Asante’s discussion outlines a multifaceted set of challenges facing the energy sector in Africa. Addressing these issues requires coordinated efforts to improve financial access, develop infrastructure, create attractive fiscal and regulatory environments, build intellectual capacity, encourage local participation, ensure cost-reflective pricing, manage inter-sectorial debt responsibly and uphold prudent revenue management practices.

Recommended development framework for Africa’s energy sector

Some of the key considerations identified by Dr Asante for a viable Energy Sector in Africa are as follows:

Governance

1. Develop a Master Plan or roadmap for guiding the development of the sector

2. Ensure a clear and appropriate Institutional and Regulatory Framework

3. Promote the building of Local Intellectual Capacity for the sustainability of the industry

4. Encourage Private Sector Participation in the development of the sector

5. Manage the Resource Revenue prudently along the chain to minimize sector debt

Commodity Security & Monetization

1. Provide sustainable and reliable Commodity Supply (supply plan)

2. Develop an Appropriate Balance for both Local and Export markets (demand plan)

3. Minimize the Delivered Cost of Commodity with minimum Fluctuation

Financing and Infrastructure Assurance & Security

1. Facilitate access to capital for projects (with an attractive Fiscal Regime)

2. Ensure adequate and reliable infrastructure that links the supply sources to the markets

3. Develop effective Operations & Maintenance Protocols including Infrastructure Protection

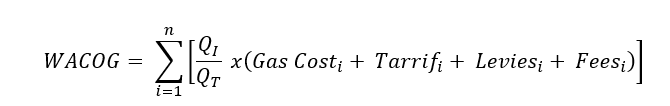

Delivered gas pricing equation

Dr Asante presented the delivered gas pricing equation. The delivered gas pricing equation is a comprehensive formula used to calculate the final price that a consumer pays for natural gas. This price includes various components to account for the costs incurred from production to delivery.

The delivered gas price equation can be expressed as:

Here’s a breakdown of the typical components involved in the equation:

WACOG: Weighted Average Cost of Delivered Gas, $/MMBtu

Qi: Flow c) associated with each Commodity source, Service type, Levies & Fees, MMBtu/d

QT: Total System Flow/c), MMBtu/d

Gas Cost: Gas or Commodity Cost from the supply source, $/MMBtu

Tariff: Tariff or Service Cost (gathering, processing, transmission), $/MMBtu

Levies Regulatory Levy, $/MMBtu

Fees: Gas Management Fees, $/MMBtu

Understanding the delivered gas pricing equation is crucial for consumers, businesses, and policymakers to make informed decisions regarding energy consumption, budgeting, and regulatory measures. It also highlights the various factors that can influence gas prices, from market dynamics to infrastructure and regulatory policies.

He then compared two commodity price models. He argued that the integrated market model accounts for all the costs of major infrastructure, which may not be relevant for small businesses, thus increasing the price of energy across the board irrespective of the size of the organization or need. However, he marked the segregated market model as a fairer market model where the energy price is based on context.

Case Study – CO2 emissions reduction in Takoradi Enclave in Ghana

This was a pretty easy and straightforward case. It was a comparison between the use of gas versus oil in Takoradi Enclave for power generation. The total Power Generation in Takoradi Enclave is 1000 MW.

For a linear alkane with n carbon atoms, the stoichiometry for complete combustion is:

Gas

Gas Rate required 168 MMscfd

Tons/day of CO2 (produced) 3,620

CO2, Tons/year 1,321,707

Oil

Equivalent Oil Rate 38,960 bbls/day

Tons/d of CO2 [produced) 22,834

CO2, Tons/year 8,334,374

Based on the decision to use gas instead of oil, 7 million tons of CO2 emissions were prevented annually. This is where I pause to link this to the topic of energy justice. Granted, the world needs to cut back on emissions to save the earth; however, it must be made clear that what we call “decarbonization and energy transition” is relative to geographical context. The transition from oil and gas to renewable energy is perhaps more appropriate for developed countries and the West in general than it is for a continent like Africa, which still suffers from a lack of energy access. What developed countries and climate change advocates request from Africa is to transition from energy poverty to more energy poverty. This is unfair and bears no resemblance to energy justice.

The West, perhaps, needs to decarbonize so that Africa can industrialize.

Temitope Solanke

Transitioning from oil to gas is a better sell in terms of decarbonization or energy transition for Africa, and we have started doing that now!

The Theme - Embracing Innovation: Redefining the Future of the Oil & Gas Industry in Africa

I found the theme very relevant and timely for Africa. Embracing innovation has become imperative for African oil and gas companies to remain competitive in a rapidly evolving global landscape. The advancements in technology and artificial intelligence can be employed in African oil and gas operations. As Africa navigates this transformative journey, embracing technological advancements will be key to unlocking its full potential and securing a prosperous energy future.

Innovation and technological advancements are not new to the oil and gas industry. The global industry has experienced and embraced innovation from its inception to the present day. These advancements can be delineated into several key stages: exploration, drilling, production, and distribution.

Exploration

In the initial stage of exploration, technological advancements have significantly improved the accuracy and efficiency of locating hydrocarbon deposits. Seismic imaging technology, such as 3D and 4D seismic surveys, provides detailed subsurface images, enabling geologists to identify potential reserves with greater precision. Additionally, the use of satellite and remote sensing technologies has enhanced the ability to survey and map remote and offshore areas.

Drilling

During the drilling stage, innovations have focused on increasing efficiency and safety. Directional drilling and horizontal drilling techniques allow for the extraction of oil and gas from difficult-to-reach reservoirs, maximizing resource recovery while minimizing surface disruption. Automation and robotics have also been introduced to perform repetitive and hazardous tasks, reducing the risk to human workers. Moreover, advancements in drill bit technology and real-time data analytics have improved drilling speed and accuracy.

Production

In the production stage, enhanced oil recovery (EOR) techniques have revolutionized the ability to extract additional resources from existing fields. Methods such as water flooding, gas injection, and thermal recovery help to increase the yield of mature fields. Digital technologies, including the Internet of Things (IoT) and advanced sensors, enable continuous monitoring and optimization of production processes. Predictive maintenance using artificial intelligence (AI) and machine learning (ML) helps to anticipate equipment failures and reduce downtime.

Distribution

Finally, in the distribution stage, technological advancements have streamlined the logistics and supply chain of oil and gas products. Blockchain technology is being adopted to ensure transparency and security in transactions and supply chain management. Advanced pipeline monitoring systems and smart grid technologies help maintain the integrity and efficiency of distribution networks. Additionally, improvements in liquefied natural gas (LNG) technology have expanded the possibilities for transporting natural gas over long distances.

Collectively, these technological advancements across various stages of the oil and gas industry contribute to increased efficiency, safety, and sustainability, driving the industry towards a more innovative and resilient future.

However, this theme addresses embracing innovation in the oil and gas industry in Africa. Coming from a production assurance background, I found the aspect of digital technologies, artificial intelligence, and machine learning very relevant to addressing issues such as predictive maintenance, production optimization, and efficiency, etc. The panel sessions addressed different aspects of the Summit theme.

Panel session 1 (& summit theme) - Embracing Innovation: Redefining the Future of the Oil & Gas Industry in Africa

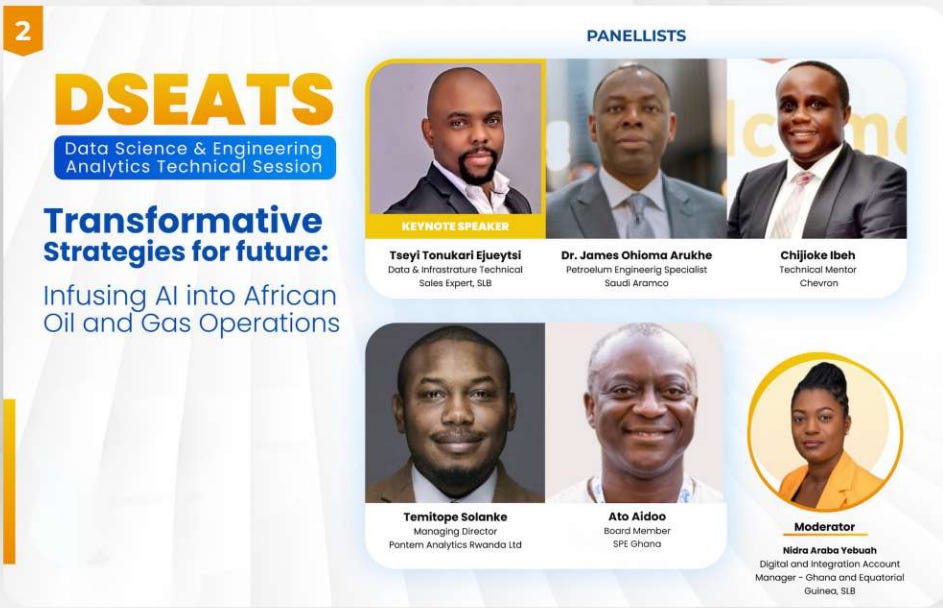

Panel session 2 – Transformative Strategies for the Future: Infusing AI into African Oil and Gas Operations

Panel session 3 – Leveraging Multigenerational Experience to Drive Innovation in Africa’s Oil and Gas Industry

The summit held several sessions for the young professionals, which included an away day, workshop, and debate championship. There was a realization that the future the African oil and gas industry seeks must involve investments in our young professionals.

My contribution: Panel Session 2

In the second panel session, in which I took part, we delved into topics that interconnected with all the other panel discussions. It was enriched by distinguished speakers from leading oil companies like Aramco and Chevron, as well as service providers such as Schlumberger. As previously mentioned, my emphasis was on fostering collaboration and partnerships. Enclosed is a snapshot of the panelists engaging in the discussion on "Transformative Strategies for the Future: Infusing AI into African Oil and Gas Operations."

Why is this topic important for Africa and the African oil and gas industry?

It was important to start from a wider perspective and clearly outline the reasons for seeking advancements in technology and adopting innovation. I began my talk as part of the panel by stating that the efforts in proffering transformative strategies, such as infusing AI into African oil and gas operations, aim to increase energy access and eradicate energy poverty through innovative solutions, whether policy-driven or technical.

I emphasized the importance and role artificial intelligence can play in predictive maintenance, asset optimization, and reducing downtime in oil and gas operations.

Techniques like time series prediction, anomaly detection, and deep reinforcement learning have huge potential in the areas of predictive maintenance and optimization. Specifically, with a technique like Deep Reinforcement Learning (DRL), we have seen the integration of subject matter expertise with AI add value to clients in various industries, not just oil and gas. For example, anomaly detection models trained on ESP performance data can flag anomalies in performance that could potentially result in downtime. Additionally, in process start-up, a portion or the entirety of the start-up can be managed by a DRL agent trained in conjunction with subject matter expertise, allowing operators to focus on other aspects of a plant. Reducing downtime, operating costs, and safety issues, and optimizing production contribute to increasing energy access, whether directly or indirectly.

Collaboration and Partnerships

To achieve the above, international, and local collaboration/partnership is imperative in the African sphere, and I highlighted 3-4 threads.

The role of government and society.

The role of international partners.

Technology partnerships.

The role of government and society

The broader context of partnerships and collaboration must be addressed before drilling deep into technology and digital partnerships. I got some insights from the executive chairman of the African Energy Summit, who also shared his views on resource nationalism. Governments do have to partner with energy companies through joint ventures or production-sharing contracts. All these are partnerships in the real sense of it. However, many African leaders, people, and civil society groups, often assert, "This is our oil. This is our country." This perspective creates an "us versus them" mentality, suggesting that outsiders are here to take our resources. We need to shift away from this mindset. It’s not only flawed but also detrimental to our industry and to the average person. We must acknowledge that resource nationalism, or what I call “resource protectionism,” is as damaging as societal plagues such as racism or sexism.

Yes, the oil belongs to us, and that’s undeniable. But until we have the technical expertise and financial strength to extract our oil and gas like companies such as the oil giants, why are we creating hurdles instead of encouraging production? Our focus in Africa should be to increase production, thereby improving energy access to the half a billion Africans without access to energy and power. Are we not tired of the epileptic power we have in Africa? It often seems like our governments forget that investors are spending huge amounts of money to make these projects succeed, and ultimately, their success will benefit us, too.

The success of partners and investors in Africa is our success, too, so why sabotage, undermine their efforts, and create roadblocks?

Temitope Solanke

Xenophobic attitudes toward expatriates or foreign workers infiltrate the entire system, ultimately harming the African people we strive to support and uplift. Africans have journeyed around the world, advocating, and protesting for dignity and respect. When we embrace resource protectionism, we replicate the very behavior we have opposed in our own dealings. This approach makes us less likely to create a welcoming environment for investment, less transparent, less inclined to develop effective local content policies, and less able to benefit from knowledge exchange, capacity building, and valuable public-private partnerships. History shows that no nation has thrived through protectionism, and if we adopt this approach, we risk significant loss.

For collaboration and partnerships to thrive in Africa, government and society must create an enabling environment that will attract an influx of investment, technology, and collaboration.

Africa is not in need of foreign aid; we need investment, which can only be achieved by way of collaboration and partnerships.

Temitope Solanke

The above was my initial opening to the topic of collaboration and partnerships, which then led to the role of international partners.

The role of international partners

As we are all aware, partnership is a two-way street, with obligations on both or all parties involved. While it is important for governments to create a friendly and enabling environment, it is also imperative for partners to engage in a manner that adds more than just monetary value to the countries they operate in. I guess what creates tensions between international partners and governments stems from the view that partners are only interested in investing to get products and profits, which are then returned to the partners’ countries without any view to supporting the local community or government. To be fair, this has been seen in the years of exploration and production in Africa, where fossil fuels produced are sold off to international buyers and no investment in downstream sectors such as refineries is implemented by the oil giants. This adds to the issue of lack of energy access in Africa. The oil produced is sold off, and the refined products are bought back for a much higher premium, which makes it difficult for people to afford to power their cars and homes.

I stated that international partners must have a different set of motives other than just making profits and focusing on creating value in the countries in which they are operating. If you produce oil in a country’s basins or have technology partnerships or business operations in a country, then you should be ready to also consider the following:

Develop local human capacity: It is not enough to staff up your operations with 100% expats; that does not add as much value as training locals to be part of the operations. The importance of foreign companies building up local human capacity in the countries where they operate cannot be overstated. By investing in the education, training, and development of local workers, these companies help create a skilled workforce that can contribute to the long-term growth and sustainability of the industry. Empowering local employees with the necessary knowledge and skills not only enhances productivity and innovation but also fosters economic stability and social progress within the host country.

Building local human capacity helps bridge the gap between global standards and local practices, ensuring that operations run smoothly and efficiently. It also promotes a sense of ownership and pride among local workers, leading to increased job satisfaction and loyalty. Moreover, it helps mitigate the potential for social and economic disparities, as local communities see tangible benefits from the presence of foreign companies.

On the other hand, failing to build local human capacity can lead to several challenges. Without proper training and development, the local workforce may lack the skills required to meet industry standards, resulting in decreased productivity and efficiency. This can lead to increased operational costs and potential delays in project timelines. Additionally, a lack of investment in local capacity building can foster resentment and distrust towards foreign companies, as local communities may perceive them as exploitative and uninterested in their well-being.

Furthermore, relying heavily on expatriates and foreign workers can create dependency and inhibit the development of local expertise and leadership. This can lead to a brain drain, where talented individuals seek opportunities elsewhere, exacerbating the skills gap and hindering economic progress. In the long run, neglecting local capacity building can undermine the sustainability of operations, as foreign companies may struggle to maintain a competent and motivated workforce.

Foreign companies have a crucial role in developing local human capacity, which benefits both the host country and the companies themselves. Fostering local talent ensures operational efficiency, promotes economic growth, and builds positive relationships with local communities. Conversely, neglecting this responsibility can lead to operational challenges, social tensions, and hindered development.

Pontem Analytics has shown a good example in this sphere by employing and training local resources where it operates. We deem it fit to contribute to developing local human capacity. In Rwanda, we have employed two talented locals, who are being trained locally and by teams in USA, Cyprus, and Australia. By so doing, we are making global content local in Rwanda. As we explore new partnerships in Africa, we are looking to inculcate the same ethos to build human capacity and empower the local workforce wherever we operate.

Encourage local content in the supply chain: The supply chain of partner companies should reflect a level of local content that helps develop local communities and helps in the creation of small businesses. Encouraging local content in the supply chains of foreign companies is vital for fostering sustainable economic growth and development in host countries. By prioritizing the use of local goods, services, and labor, foreign companies can contribute significantly to the economic health of the communities in which they operate.

One of the primary benefits of local content is job creation. By sourcing materials and services locally, foreign companies can stimulate employment opportunities for local residents, helping to reduce unemployment rates and improve living standards. This, in turn, leads to a more skilled and experienced workforce, which is essential for the long-term growth and sustainability of the industry.

Additionally, encouraging local content can help build a robust network of local suppliers and service providers. This diversification strengthens the local economy by reducing dependency on imports and enhancing the resilience of local businesses. As these businesses grow and gain experience, they become more competitive, not only locally but also in the global market.

Furthermore, the use of local content fosters technology transfer and knowledge sharing. When foreign companies engage with local suppliers and contractors, they often bring advanced technologies and best practices that can be adopted and adapted by local firms. This exchange of knowledge and expertise helps to raise the overall standard of local industries, driving innovation and efficiency.

However, there are challenges to implementing local content policies effectively. One significant hurdle is the potential lack of capacity and quality among local suppliers. Foreign companies may encounter difficulties in finding local businesses that meet their stringent quality, safety, and delivery standards. To address this as stated in the previous section, companies can invest in training and development programs to build the capabilities of local suppliers, ensuring they can meet international standards.

Create value chain locally: This, in the oil and gas industry, is just as important as the others because it is intrinsically linked to the topic of energy access and energy poverty. Oil and gas produced in Africa should go through the entire value creation locally to help in ensuring that people have access to cheap energy and power. Nigeria is an example to explain this challenge and opportunity. For so many decades of producing fossil fuels, Nigeria has been plagued with a lack of energy access and epileptic power because of the lack of refineries, and the few in existence are not in operation due to a lack of maintenance and management. Having to buy expensive refined products from other continents has been an issue and stunted infrastructural development in the country because the bulk of its income is spent on petroleum subsidies.

This trend is observed in other industries, such as mining, technology, and even agriculture. Cocoa is exported to Western countries, and Africa buys it back in the form of products such as chocolates. Foreign companies and international partners must be intentional in ensuring that the value chain is created locally as well.

Technology (and Digital) Partnerships

I spent more time on this aspect because of its importance in driving the efforts to infuse AI into African oil and gas operations. The fast-paced evolution of artificial intelligence (AI) and digital technologies presents both opportunities and challenges for the African oil and gas industry. To keep up with these rapid advancements and avoid the pitfalls of starting from scratch, it is imperative for companies to engage in strategic partnerships and collaborations. These alliances enable the industry to leverage existing technologies and expertise, accelerating innovation and ensuring competitiveness in a swiftly changing digital landscape.

One prominent example of such a partnership, albeit not specific to the oil and gas industry alone, is the collaboration between Microsoft and OpenAI. Through this alliance, Microsoft has integrated advanced AI capabilities, such as those from ChatGPT, into its cloud services, making cutting-edge AI tools more accessible to businesses across various industries, including oil and gas. This partnership exemplifies how leveraging external expertise can expedite the deployment of sophisticated technologies, enhancing operational efficiency and decision-making processes.

In the African context, partnerships like the one between IBM and Eni, an Italian multinational oil and gas company, demonstrate the power of collaboration in the digital space. IBM's AI and cloud computing solutions have been employed to optimize Eni's upstream operations, resulting in improved exploration and production efficiency. This collaboration has enabled Eni to harness vast amounts of data and apply advanced analytics to make more informed decisions, ultimately boosting productivity and reducing costs.

Another notable example is the collaboration between TotalEnergies and Google Cloud. This partnership focuses on using AI to analyze geophysical data, thereby enhancing the accuracy of oil and gas exploration. By integrating Google's AI capabilities with TotalEnergies' domain expertise, the companies have developed advanced models that significantly improve the identification of potential hydrocarbon reservoirs, reducing exploration risks and costs.

In addition to these high-profile collaborations, there are numerous regional partnerships that highlight the importance of local expertise and context. For instance, the partnership between Nigeria's National Petroleum Corporation (NNPC) and Schlumberger, an oilfield services company, aims to deploy digital technologies to enhance oilfield operations and training programs for local talent. This collaboration not only improves operational efficiencies but also builds local capacity, ensuring sustainable development and knowledge transfer within the region.

These examples underscore the critical need for partnerships and collaborations in the African oil and gas industry's digital transformation. By aligning with technology leaders and leveraging their advanced solutions, African oil and gas companies can stay ahead of the curve, drive innovation, and maintain a competitive edge. Such strategic alliances ensure that the industry can rapidly adapt to technological advancements, optimize operations, and contribute to the continent's economic growth.

Partnerships and collaboration in the creation of digital twins

In the oil and gas sector, the creation of digital twins for assets necessitates a seamless collaboration among various stakeholders, including control system vendors, technology application providers like Schlumberger and AspenTech, IT providers, and more. These digital twins, virtual replicas of physical assets, require an integration of expertise and resources from multiple domains to deliver comprehensive insights and value.

Digital twins are the foundation of future collaboration

Authena.io

Control system vendors contribute their expertise in designing and implementing systems that collect real-time data from assets. Technology application providers like Schlumberger and AspenTech bring domain-specific knowledge and advanced analytics capabilities to the table, enabling the interpretation and analysis of vast amounts of data generated by the assets.

Additionally, IT providers play a crucial role in ensuring the integration, security, and scalability of the digital twin platform. Their expertise in cloud computing, cybersecurity, and data management is vital for creating a robust infrastructure that supports the digital twin's operations.

By working together, these stakeholders can overcome the complexities of integrating diverse data sources, ensuring data accuracy, and developing predictive models that enhance asset performance and decision-making. Collaboration fosters innovation, accelerates time-to-market, and ultimately enables oil and gas companies to unlock the full potential of their assets in the digital era.

After the panel session, gifts were given to the panelists.

Conference Dinner and Closing

SPE Ghana hosted an unforgettable dinner, highlighting the rich cultures of Africa and Ghana. Awards were presented to outstanding SPE members who demonstrated excellence in their profession and contributions as SPE members and officials. The Global President of SPE delivered remarks, expressing gratitude to all attendees for their participation. Attached is a photo of myself with the SPE President.

Additionally, a lively debate between the Nigerian and Ghanaian SPE chapters added excitement to the event. Much like the spirited discussion over Jollof rice (for those familiar with it), the debate was intense, with Ghana emerging victorious.

Overall, I was thoroughly impressed with the event's organization and execution.

Summary

The second edition of the Society of Petroleum Engineers (SPE) Ghana Biennial International Summit and Exhibition held in Accra proved to be a dynamic and transformative gathering. Over the course of three days, industry leaders from across Africa and beyond converged to discuss and strategize the future of the oil and gas sector, with a particular emphasis on integrating artificial intelligence and innovative technologies into African operations. Keynote speeches, including the insightful address by the CEO of Ghana National Gas Corporation, highlighted the multifaceted challenges and opportunities within Africa's energy sector, from financing and infrastructure to regulatory frameworks and intellectual capacity building.

The summit’s theme, “Embracing Innovation: Redefining the Future of the Oil & Gas Industry in Africa,” underscored the urgent need for technological advancements to enhance operational efficiency and sustainability. Panel discussions, including those I participated in, delved into the transformative potential of AI in predictive maintenance and asset optimization, emphasizing the importance of international and local collaborations to drive these initiatives forward.

The event also stressed the critical role of developing local human capacity, fostering private sector participation, and ensuring prudent resource management. As Africa navigates its energy transition, balancing decarbonization with industrialization remains paramount to achieving energy justice and economic growth.

In conclusion, the summit successfully fostered a collaborative environment where innovative strategies and technological partnerships were discussed and promoted, setting the stage for a more resilient and forward-looking African oil and gas industry.

Thanks for this comprehensive writeup. We are grateful you honoured our invitation and for sharing your expert knowledge with us.

It really was a memorable event.