Writing the Book on Wax

Waxing Lyrical on...wax

With SM Energy’s recent entry into the Uinta basin (via XCL), wax is back! SM’s portfolio is transitioning to a new basin…accompanied by a unique and sticky situation.

We have written several previous posts about wax and all-things paraffin before. Here at Pontem, we sometimes take it for granted that wax issues are well-known and understood, probably because it feels like we helped write the book on wax. More on that later…

SM Energy Backstory

As it relates to SM Energy, we have had a unique relationship with them…even before they were SM! Dating back to the days when they were St. Mary Land & Exploration, I have followed their expansion closely, including being in attendance when they rang the closing bell at the NYSE to celebrate their 100 years of listing.

But a purpose-driven relationship with SM, we collaborated in their ‘Hiking For Hearts’ program, benefiting the Children’s Hospital of Colorado, through multiple organized Colorado hikes. ~25% of my own 30+ 14’er summits have been with SM staff!

But getting back to SM Energy’s pending entry into this Utah basin, we thought it was a good time to recap some of interesting thoughts related to wax and our involvements in similar areas.

To say the the Uinta crude is ‘waxy’ is an understatement. With a pour point of ~110°F and likely >20wt% paraffin content, the crude is difficult to transport and generally unresponsive to conventional chemical inhibitors. This necessitates insulated truck and/or rail transport for nearly all of the produced oil, either to local Utah-based refineries or potentially further destinations with additional rail infrastructure.

However, that small issue aside, the fluid itself is a beautiful and refinery-ready crude (no metals, sulfur, acids, or other nasties…except for the paraffins). The high paraffin content makes it extremely desirable for refineries that have been configured in the Salt Lake City area, which has ~100,000 bpd of high paraffin content refining capacity.

Why So Waxy: A Villain Origin Story

While not globally unique, the Uinta crude is known for its waxy position within the US onshore market. The problematic oil - like any good villain - has a unique origin story. In this case, we can trace its issues back to the beginning…its lacustrine origin.

Without doing a deep-dive down a geologic rabbit hole, the term lacustrine means “relating to or associated with lakes”. As such, the organic material that decomposed to create the hydrocarbon (oil) deposit is mainly plant-based, with a large portion of those plants containing waxy materials. In comparison, most conventional marine environments have deposit origins from organisms such as plankton, which contain some waxy materials but not nearly as much as plant leaves. As such, lacustrine-based oils can easily have >20wt% paraffin, while marine oils are typically <10wt%.

(As an aside, the lacustrine environments typically also have much fresher formation water, often <10,000 mg/l TDS. But maybe more on that in a separate post…)

In fact, one of our previous posts about Lake Kivu (Rwanda) was also inspired by another lacustrine geologic feature to create its own unique hydrocarbon (gas) environment.

The Uinta (and Green River) Basins sit in the Uinta Mountain valley, with the Green River coursing through and in proximity to the neighboring Great Salt Lake, evolving into this lacustrine formation. The area is a bright spot on the map of global lacustrine sources (see below).

Also on the map, areas of interest featured prominently are the eastern coast of South America / western coast of Africa - a true hotbed of offshore oil development activity. Several of the African crude oil projects such as Chevron’s deepwater Aseng asset and various transmission pipeline across the continent (Uganda’s EACOP / Chad-Cameroon’s COTCO, just to name a few) are also plagued by production and transportation issues due to their own high wax contents.

Ultra-Remote Waxy Development: Falkland Islands

Last but not least, in a small spec on the map near Antarctica, there is another lacustrine “dark spot”. Through our geologic lens, that usually means something interesting is lurking…and so we bring you the Sea Lion field (offshore Falkland Islands), another high wax content mega oilfield set for FID later this year that Pontem has been involved with since discovery 10+ years ago.

Now operated by Navitas Petroleum Development, Sea Lion is a deepwater discovery (450m water depth), approximately 220km to the north of the Falkland Islands. (Side Note: In the small world of oil/gas, we actually met Navitas’ current CEO Gideon Tadmor in Israel as part of Noble Energy’s Tamar start-up, some 10+ years ago. Talk about playing the long game...)

Back to Sea Lion, this lacustrine discovery holds 300+ MM bbl of recoverable, waxy oil. Navitas has recently issued their Environmental Impact Assessment, where several of the wax-related properties (and issues) are spelled out. In fact, wax is mentioned 100+ times in the report! Among the most interesting are:

Oil Characteristics:

Wax Content - 23wt% (n-alkane) - 42wt% (wax crystallization)

Wax Appearance Temperature - 60°C (140°F) - Subsea / Multiphase, 66°C (151 °F) - Topsides / Storage

Pour Point - 36°C (97°F) - Subsea / Multiphase, 25°C (77 °F) - Topsides / Storage

System Design Challenges:

Subsea system is to be insulated to ensure arrival at/above Wax Appearance Temperature, as well as mitigation plans in-place to manage any potential solidification during shutdown

Water injection system (for Enhanced Oil Recovery) required to be heated to prevent wax formation when water contacts oil in the reservoir. Energy costs and metallurgy selection challenges for a heated water injection system are both considerable.

Vessel Design Challenges:

All oil vessels, piping, and instrumentation to be heat traced and/or insulated. Oil cooled to storage temperature such that it remains pumpable for offloading

Oil spill offshore Challenges:

Due to waxy nature of crude, oil did not respond to chemical dispersal tests. Skimmers were not a viable response option either.

High potential for ‘solid waxlets’ to reach shore in the event of an environmental release. Biodegradation of oil is expected (due to high alkane content), but will take some time (7+ days)

Iceberg Management Plan is required to mitigate potential catastrophic release events

Overall risk assessment for a release and environmental impact was deemed ‘Very Low’ or ‘Low’, with detailed oil spill modeling to support. In nearly all cases, the waxy nature of the oil - in this case - had a positive outcome due to the solidification of the oil. “Given the low solubility of the Sea Lion crude, concentrations are almost all small wax particles and very little of the oil is present in the more hazardous dissolved form”.

Spoiler Alert: We plan to dive deeper into the Sea Lion field development in a subsequent post, so stay tuned for more information on that asset and some of the technical challenges (wax and non-wax related) in the coming weeks…

Treatment Challenge: Better Living Through Chemistry?

One of the unique challenges of waxy crude oils, similar to the Uinta and other basins, is the difficulty in ‘conventional’ treatment options. While we know heat is a solution, providing heat - via insulation for pipeline flow or via heated storage tanks to keep the fluid above the Wax Appearance Temperature or the Pour Point - is expensive. Particularly when needing to supply heat over long distances and/or durations, this may also be technically impractical. Commonly, we turn to other active measures such as production chemicals to avoid the heating needs.

But, why is chemistry NOT the answer here? Well, it just takes an understanding of how most typical paraffin inhibitor chemistry works to see the red flags clearly. Chemical options tend to fall into one of two categories:

Wax Dispersants: Tend to be surface active, small molecule, organic compounds that work by disrupting the interaction of wax particles to limit their size and tendency to deposit. Effective applications will minimize large paraffin crystal structures from forming or depositing, while keeping them dispersed in the oil phase. As surfactants, there is some schools of thought suggesting they help keep the pipe surface water-wet, and hence not well suited to allow paraffin deposits from forming. The chemistries to tend to be more effective when some water is present. Injection locations must be upstream of the WAT. Dispersant formulations are typically multi-component and actives tend to have specific oils where they perform more effectively. Because their mechanism is based on association/disruption of nucleation/crystal growth, there are limitations where too much paraffin can overrun the system leading to an ineffective application.

Crystal Growth Modifiers: High molecular weight polymers designed to disrupt the crystal structure of a paraffin crystal network. Chemically, they tend to be block copolymers or random copolymers. Once these polymers are associated within a crystal network, the disrupted morphology limits further agglomeration and deposition processes. Active components are tailor-designed for specific molecular weight paraffins (or a broad carbon chain length). This creates some limitations if a crude oil has a large population of n-paraffins outside of this target. Additionally, from a mass balance perspective, high wax content can overrun the mechanism of CGM’s.

In a nutshell, these highly waxy fluids simply have too much wax for most reasonable chemical applications to be effective. The most effective wax inhibitors have characteristics similar to the wax precipitates that are being targeted and because each field is unique in the distribution and type of wax precipitating (e.g. straight chain lengths, cyclic moieties, branched chains, etc.). In many cases, a chemical that works well for one fluid will work poorly for others.

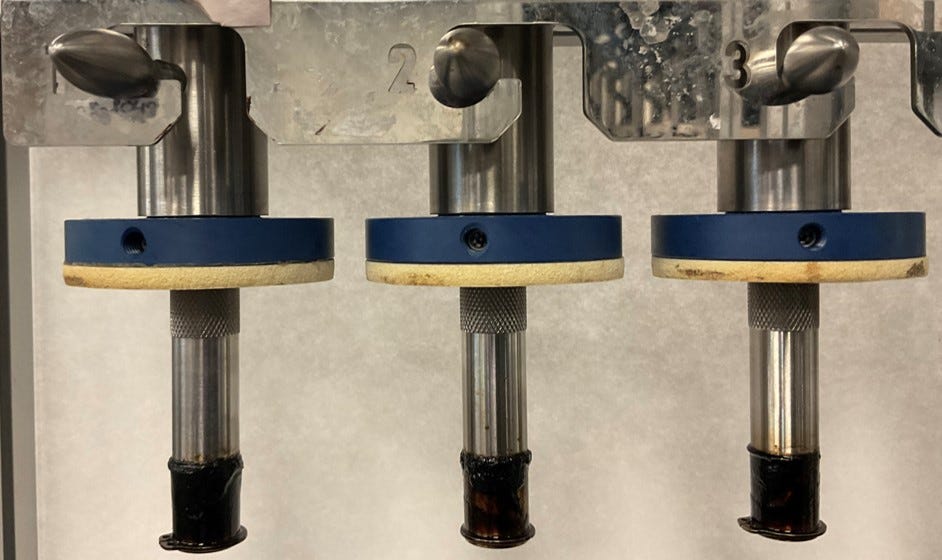

Data below shows wax inhibitor testing (both wax deposition performance and pour point suppression) for a high wax content fluid, using both commercially-available inhibitors and some new options under development. In most cases, the chemicals fail to make an appreciable impact on the paraffin-related issues, even up to 2000 ppm dosage basis. And, they don’t offer a full-stop solution.

Considering deploying some of the potential best candidate inhibitors in a challenging environment faces other challenges, mainly whether the chemical itself is ‘pumpable’ to the wellsite. Be it subsea/deepwater or cold/arctic areas, chemical stability and viscosity at low temperatures is a major concern. Dilution of the product to make it deliverable may compromise its efficacy.

Relationship Goals: Wax + Us

We first met ‘Wax’ 20+ years ago when operating a state-of-the-industry deposition flowloop, on behalf of several major operators. This provided us with “hands-on” experience running the loop and understanding the important wax-related variables that impact deposition. It was here that we collaborated with my friend, the famous Dr. Bazlee Mat-Zain (yes, that MATZAIN from the wax deposition correlations). Even though Dr. Bazlee was part of the University of Tulsa wax family (who, like the mafia, where in an academic battle with my own University of Michigan wax family), we managed to get along. I guess when your flowloop comes from Ponca City (OK), you are forced to play nice with the Tulsa crowd.

It was also here where we were responsible for authoring the Deepstar (industry coalition) guidelines on all things wax, including a comprehensive assessment of test methods, modeling methodology, and field data benchmarking.

Fast-forward to our next venture, where we built and operated more wax flowloops (and related equipment such as cold fingers and rheometers). More hands-on experience with various types of crude from across the globe, including some of the waxiest oils in the world.

It was here where we funded wax- (and asphaltene-) related research at the University of Michigan over a span of multiple years. Aside from assisting with funding for PhD students, we coordinated and led a Technology Transfer program where we developed / deployed their wax research into commercially-available models.

Working with the late Professor Scott Fogler (and ultimately hiring some of his best students/co-authors…), we assisted in the technical peer review of his ground-breaking textbook on all-things wax. In fact, we even got a shout-out in the book (definitely “nerd-famous” now).

Coming Soon: More Wax

The quest for more energy resources often necessitates we push the boundaries of both accessible fluids and development technologies. Inspired by Utah’s Uinta Basin activity - and with more discussion on the Sea Lion development - we have two upcoming wax-related posts of interest.

Keep an eye out for:

Waxy Crude Transmission Pipelines - Africa’s Energy Opportunity

Gas/Condensate Paraffin Issues - Getting Lean Over Time

While our last company outing to Utah didn’t include any Uinta waxy crude, our recent field trip to Cameroon did focus on their 1000+km waxy crude pipeline from Chad (and we didn’t need to wait for their ski season).