Texas Projects Update

Howdy, Y'all

This week, Pontem will be supporting two big events, both in our Texas backyard:

Texas Energy Council, TEX (Dallas): 02-May, sponsoring multiple scholarship opportunities, continuing our emphasis on investing in education and energy stewardship.

Offshore Technology Conference, OTC (Houston): 03-May, bringing in our colleagues from across the world to attend technical sessions (as well as our annual - always sold-out - Astros outing).

It should come as no surprise that Texas has become not only the United States’ energy epicenter, but also one of the key global market-movers. There are plenty of resources listing Texas’ oil/gas production and the popular “where would Texas rank if it was its own country?” There is a reason why things like OTC, NAPE, and CERAWeek all end up in Texas (and, sorry to my “northern” neighbors, why they end up in Houston vs. Dallas…) Needless to say, Texas moves the needle.

We have spent a lot of time writing / speaking about interesting projects and case studies from around the world, building out Pontem’s global footprint this past year. But, what about Texas? Not quite “All my Exes Live in Texas”, but we could easily sing “Most of our Projects Live in Texas”. Let’s do a quick recap of our more interesting projects in the Lone Star State, offshore (deepwater) and a surprisingly large number of onshore projects across the various TX basins. Maybe its finally time to open that Pontem Midland office….

East Texas (Haynesville): Natural Gas

With natural gas prices near all-time lows amid production gluts due to Freeport LNG delays, gas wells have obviously been uniquely challenged. Faced with the prospect of simply shutting in, risking wells loading up, and demob-related costs, operators are working diligently to chase cost downward.

We have spoken previously about looking at optimizing both the production side and chemical side. It was a mixed bag, where certain wells responded well to chemicals while others were less impacted. Additionally, understanding the fundamental physics of well build-up and pressure cycling offers some insights into how we can leverage what we are “seeing” in the field vs. what’s happening on a fundamental level.

We often attempt to extract what is the ‘secret sauce’ from experienced pumpers brains who are comfortable “working a well” to revitalize it…but how can we ‘codify’ that knowledge? Certainly no “one-size-fits-all” approach, we can start to cobble together of all the information we know into a central knowledge base that allows us to be more predictable.

In addition to hammering away at chemical efficiency, some additional areas have shown promise in getting costs down to keep our collective heads afloat.

Route optimization (reduced pumper times) - by being smarter about the wells serviced and frequency of visits, there are costs savings to be had. Not to mention less truck-miles / lower carbon footprint, both of which are “real” savings that offer a roadmap for sustained efficiencies even at higher commodity prices. We believe chemical optimization - integrated with chemical logistics (tote refill timings, reduced truck miles, etc.) - offers a real opportunity that benefits both supplier and producer.

Compression optimization - looking at more efficient ways produce, potentially in a free-flow environment, to balance lower production vs. lower take-away costs. We also see potential in balancing compression capacity vs. transportation costs, whereby keeping utilization high on units without burdening smaller volumes with excessive tariffs. A collaborative approach for both upstream/midstream.

There are more in the hopper, including some non-traditional ways to run the well to look at the total system-wide economics (upstream production, transportation, etc.) Will hopefully be able to update those efforts in due course, good or bad.

South Texas (Eagle Ford): Dual-Phase Operation

For many traditional gathering systems, we are left with gas networks and a choice between oil networks vs. large-scale trucking operations. The potential to run those networks as multiphase (or dual-phase), eliminating trucking while balancing increased back-pressure on the wells and inlet receiving facility constraints, has been a large focus for Pontem over the last year.

By considering dual-phase, the elimination (or reduction) of trucking offers the following advantages:

Reduced GHG emissions / environmental impact

Reduced potential HSE / lost-time incidents

Lower transportation costs (per BOE)

So with the benefits clearly laid out, the task becomes helping operators understand just how much additional liquids they may be able to get away with while producing dual-phase. The issues are your standard culprits when it comes to multiphase fluids:

How do liquids accumulate in the system and what effect does that have on pressures / deliverability. And, how does that impact future build-out / expansion?

Will I see slugging issues that upset processing at receiving points?

How should I pig and how often should I pig my system to try and keep liquid build up, and thus pressures, optimized while ensuring I can handle the liquids received. This one we recently touched on in a case study.

But there’s also a number of ‘soft challenges’ associated with supporting this work. Most of the modeling/forecasting work needed to support these projects must be done in transient software not nodal/ steady state. Shout out to anyone else who’s built a 50+ pipeline model in OLGA or LedaFlow as I’m sure they can agree, it’s not a fun process! And, what’s worse, most of these systems are “oversized” based on traditional multiphase flow metrics, which leads to some additional challenges in model run-time, convergence, handling dead-legs, etc.

At Pontem we’ve perfected a set of tools and workflows that enable us to build, run, and analyze complicated models for large gathering networks.

We also believe a focus on trucking logistics, either via take-away product miles OR via supply-chain miles (chemical, frac sand, etc.) is an area ripe for optimization via integrated data analytics across the entire value chain and this is an area Pontem is starting to move into.

West Texas (Permian Basin): Forecasting Operations

We will break the Permian up into Upstream / Midstream:

Upstream

SGS Main Pointe recently published a list of 4 solutions to Permian Basin Challenges. Interesting that the top two are:

Optimization through technology

Data-based decision making

Our efforts in the upstream Permian sector have largely focused on data-leveraged optimization. With increased water production, the need for artificial lift optimization (gas lift, ESPs, etc.) has never been higher. Leveraging a Deep Reinforcement Learning (DRL) offers a potential solution to such a large, multi-variable challenge. Typically, we have better instrumentation and data access as we get closer to the reservoir, which makes a data-enabled solution easier to implement.

Treater Truck Optimization

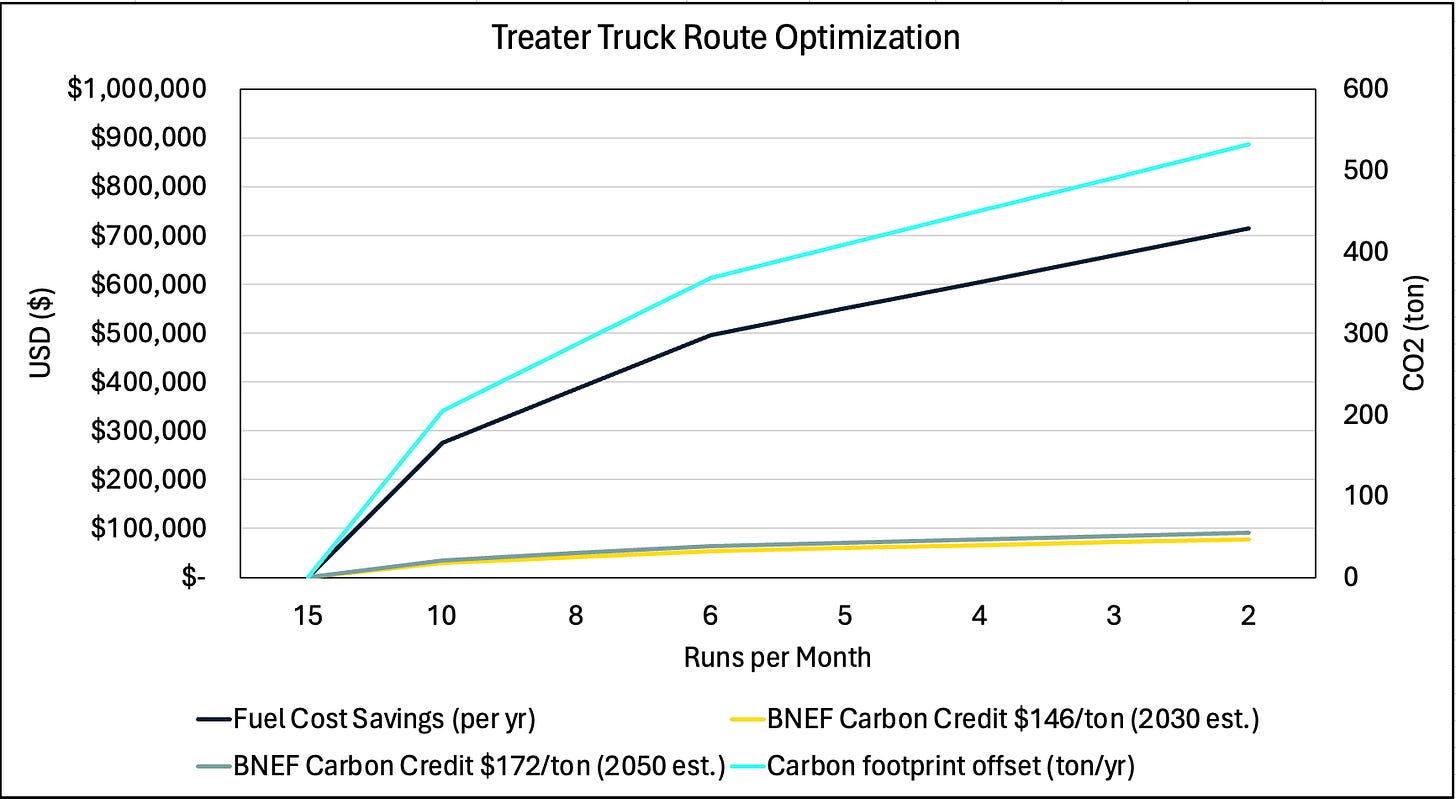

Chemical delivery in the Permian offers a lot of potential efficiency gains that would be realized in operational cost reductions, as well as potential carbon footprint offsetting opportunities. Let’s take an example using a 25-treater truck fleet, where each truck drives a 300 mile route. The baseline scenario calls for each well pad site to be visited every other day, or 15 trips per month. A fully optimized route will only require a full run when the fastest depleting chemical tank reaches the minimum volume tank level. In this scenario let’s say that is 2x per month. What are the cost savings opportunities as we move from baseline to fully optimized truck routes?

The annual fuel savings in a fully optimized scenario tops $700k, which is ~$2,200 per truck per run reduced. Additionally, this study shows ~$100k in carbon credits would be realized (based on Bloomberg’s NEF “Removal Scenario” source: https://about.bnef.com/blog/carbon-credits-face-biggest-test-yet-could-reach-238-ton-in-2050-according-to-bloombergnef-report/). The average carbon footprint for a truck is estimated at 223 tons / yr, so the optimized scenario removes 2 trucks from the road in terms of CO2 emissions. The ability to offer creative ways to enter the carbon credit marketplace is becoming an attractive feature, as is being forward thinking in how to contribute to “Net Zero” goals across the industry.

Midstream

Taking the dual-phase example above to the extreme, we have extensively supported a midstream networks in the Permian that due to significant condensate dropout from the gas phase, operates exclusively as multiphase lines, whether they would like to or not. In general, the question they want answered every week is: “What will our conditions look like next week?”

It should be more straightforward to answer than it is, but the most basic understandings of the field are often compounded in complexity with:

Variability in gas composition (liquid yield) across the network

Measurement uncertainty on heavy ends (C7+), as well as potential contaminants entering the network (H2S, CO2, O2, etc.)

Ambient temperature variations (seasonally) that drastically impact liquid drop-out

Daily pigging efforts throughout the network, often keyed off of third-party volume being on-schedule

Lack of reliable data (manual entry, missed pigging runs, GC errors, etc.)

Upstream (wells) / downstream (plant) variability

To address these, we rely on a hybrid modeling/analytics based approach. By having a fully transient model of their entire network, we can model what “should” occur based on the information we have / are confident in. As needed, we layer in analytics to explain any inconsistencies or to supplement (with physics) where data is missing.

South East Texas (Downstream): Refined Products

Starting my career in downstream, returning to these Gulf Coast projects has been nostalgic. In the “early days” of Pontem (i.e. last year), we wrote about our involvement in a downstream LNG system that was blending liquid ethane into natural gas to increase it’s heating value prior to liquefaction. As we would come to find out, hydrate problems aren’t just something that operators in the upstream and midstream space deal with…and they can even happen in balmy South Texas.

We have remained involved in the project from the early engineering days through start-up toward the end of 2023 and continue to remain active as additional potential monitoring requirements are discussed.

The project speaks to the reason Pontem exists: combining deep domain knowledge, in this case around hydrate formation risk, with the latest in the field of data analytics and machine learning, to create truly unique and value-added solutions for our clients.

Offshore (Deepwater Gulf of Mexico): Subsea Tiebacks

Admittedly, Pontem’s legacy consulting business has largely focused on offshore / deepwater projects. And that continues to play a major role due to (a) importance of production to the global economy, (b) the high-risk/high-reward stakes that are involved in deepwater, and (c) the high cost of intervention when things go wrong. While acknowledging that “most” deepwater GoM production should really be a Louisiana play (vs. a Texas play), we will take credit for GoM in our ‘Tour de Texas’.

A recent case study looked at identifying subsea blockages for a legacy field that had undergone changes in operating regimes (lower pressure / increased water cut). Screening for potential blockage risks have historically relied on “rules of thumb” and pressure monitoring. Our classic ‘traffic light system’. But, can we do better? We think so.

Layering in more data (in this case, pressure) monitoring to look for changes is helpful…but specifically changes that are “off-trend” can lead to much more streamline diagnostics. Here, we plotted pressure drop / flowrate (dP/Q) over time for several wells. Simply monitoring pressure changes may not give you the full picture (what if flowrate went up too? What is lower system pressures means higher dP due to gas expansion?), so we need to anchor this to a more physics-based understanding.

Here, we are able to start to identify wells (Top #1, Middle #2, Bottom #4/#6..maybe...) that are showing “concerning” behavior. And remember, data is usually messy and there may not always a ‘smoking gun’ so it can easily be missed. Ask anyone post-breakup about ignoring/re-discovering those “red flags” after the fact…

In this case, we were looking for potential issues related to changes in operating conditions / water chemistry. Going back to our ‘traffic light’ system, we can combine the two and realize that - while not perfect - we are at a much higher risk of issues when we have high scaling potential (those red risk areas). And, when we are trying to determine whether we have a blockage, the amount of water would surely play into the risk of increasing dP. Conspicuous by its absence, “water volume” is absent from the risk matrix…which doesn’t make sense.

Layering on one more filter (water production) in our problematic wells shows a good cross-correlation between our likely problem well (Top #1) and high water production (= high scaling risk). While is may not be a definitive predictor, it can focus operations’ next plan of action (i.e. ROV survey, density scan, etc.)

Knowing the chemistry risks associated with our fluids (i.e. scale potential, emulsion inversion points, etc.), combined with the field data (dP/Q), allowed for a targeted diagnosis of a potential blockage and further field surveillance work to confirm. Would we have gotten there eventually with just monitoring dP build-up? Probably. Would it have been too late to take less-costly remediative action? Most definitely. Better to treat the symptoms early, as opposed to the disease.

Day Trippin’ Down in Mexico…

We talk often about Gulf of Mexico, but what about our actual southern border neighbor. With the gas-rich basins in Texas, unlocking an export route providing clean, cheap gas to Mexico has been the focus of recent pipeline expansions, including TC Energia’s Sur de Texas pipeline. With a capacity in excess of 2.5 BCFD and nearly 500 miles, the pipeline has been delivering gas throughout the country for domestic consumption. There is a lot of energy (pun intended) on these cross-border cooperation agreements that continue to leave Texas as a the focal point. Andrew/I have worked on this system for the last ~10 years (across 3 companies).

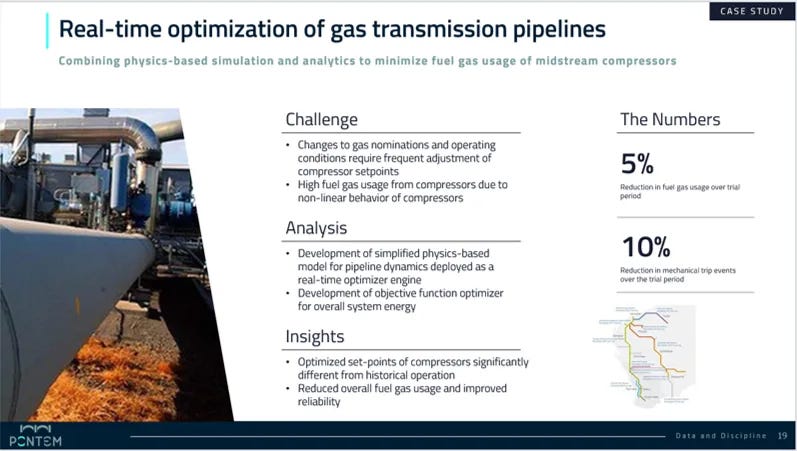

And, these pipeline have all of the gas transmission challenges that one would expect, again making them perfect for a data-driven approach to improve efficiency:

Compressor station optimization

Line pack

Gas quality / specifications / off-spec scenarios

Expansion capabilities

Mantante atento a noticias sobre nuestras actividades en Mexico en los proximos meses…nosotros estamos emocionados!

Outlook

At Pontem, we are bringing more of the integrated domain/data solutions adopted by offshore into the onshore basins. Offshore/remote operations may have gotten there quicker out of necessity, but as onshore basins expand and become resource-constrained (CAPEX, OPEX, personnel, regulatory, etc.), they are looking at the same challenges.

For onshore, just because access is easier shouldn’t be a reason not to work on preventive measures to reduce potential incidents. This ultimately results in more efficiency, higher up-time, lower chemical costs, less potential truck-road miles (and potential HSE incidents), less potential equipment needs, etc. For an individual wellpad/pipeline, it may not be worth it. But, accumulated over a basin-wide program into a “systems approach”, the total costs are considerable.

Texas is our corporate headquarters for a reason - the importance of the basin, the technical challenges, the outstanding people we work with/for, and some good ‘ol fashioned southern hospitality that you don’t find anywhere else.