Reimagining Reserves Reporting

Automating Reserves Management with Databricks

Reserves Reporting: The Lifeblood of Oil & Gas

In the oil and gas industry, reserves reporting is a critical process that quantifies a company's hydrocarbon assets - essentially their future production potential and economic value. These reports serve as the foundation for investor relations, regulatory compliance, and strategic decision-making, directly influencing market valuation and access to capital.

This is a strategic area where Pontem Analytics is expanding its capabilities, particularly through our new work stream focused on subsurface applications where we believe advanced data analytics can deliver significant value.

The Problem

Despite the importance of reservers reporting, most would agree that it remains stuck in the “spreadsheet era”.

Engineers and economists spend hours manually manipulating production, CAPEX, OPEX, cashflow, and NPV data across dozens of disconnected files. Traditional reserves workflows involve months of technical work, followed by the consolidation of outputs into spreadsheets and databases. These are then audited before being compiled into reports and visuals. Data is often sourced globally, arriving in inconsistent formats and frequently disorganized. These massive data cubes have to be distilled into something useful.

Turning this raw data into actionable intelligence is:

Manual and repetitive

Prone to version control issues

Too slow to support strategic decisions

The value of reserves data should not be underestimated, but we recognize that the industry needs to shift from simply reporting on the data to using it to drive real outcomes: identifying additional barrels and unlocking cost savings. For that reason, we set out to build our own approach to handling this data and unlocking its value for one of our clients.

Building a Better Way

We approached this challenge by reimagining the entire reserves reporting workflow. Through our partnership with Databricks we were able to leverage modern data engineering principles and cloud-based analytics, to create a solution that automates the tedious parts while enhancing the strategic value of reserves data - transforming it from a compliance exercise into a competitive advantage.

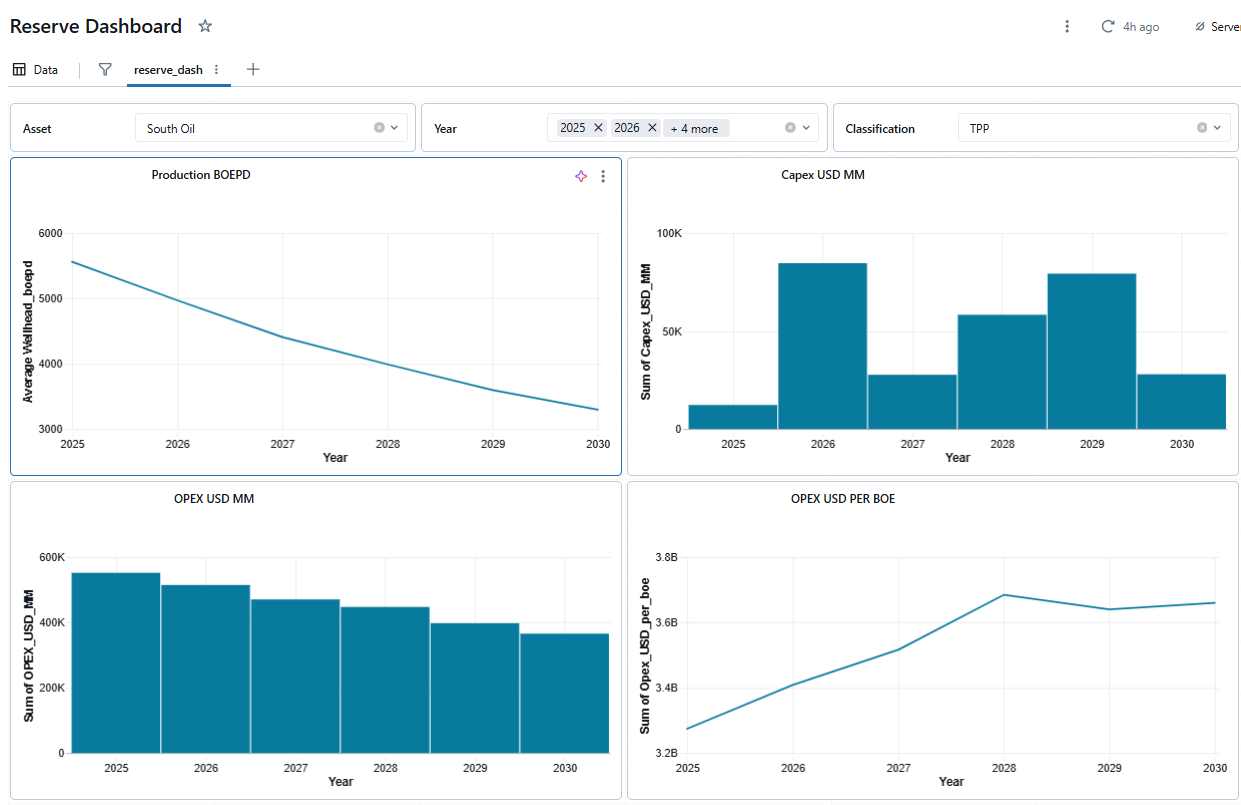

Using Databricks and generative AI, we built a modern data pipeline and reserves intelligence dashboard that automates and streamlines the entire process.

The pipeline ingests raw production, CAPEX, OPEX, cashflow, and NPV data—cleans it, structures it, and prepares it for meaningful analysis.

The dashboard, built with Databricks BI and guided by AI prompts, visualises key trends such as:

📉 Declining production (BOEPD)

💰 CAPEX and OPEX

⚙️ OPEX per BOE

📊 Cashflow and NPV

It is fully interactive, filterable by asset class (PD, PUD, etc.), and updates automatically as new data comes in. The client has found the ability to analyze year-on-year changes particularly valuable.

Impact & Results

This solution delivered tangible benefits to our client, including several days of engineering time saved, enhanced accuracy, and clear, insightful visualizations. Beyond these immediate gains, the true value lies in transforming reserves data from a compliance requirement into a strategic asset that actively guides capital allocation, competitive benchmarking, and acquisition & divestiture decisions.

Engineers and executives can now quickly filter through reserve categories and analyze year-on-year changes to identify optimal areas for medium-term investment. The platform enables users to construct detailed asset-level views that track cashflow evolution and explore sensitivities around critical inputs - turning data into actionable intelligence.

Future Developments

We're extending this same data-driven approach to well performance monitoring, another domain currently constrained by spreadsheet limitations. Our upcoming Production Optimization Dashboard will deliver the same automation capabilities, analytical clarity, and decision-making support.

This represents more than just an aesthetic improvement to dashboarding - it's a fundamental shift in workflow: faster, cleaner, and purpose-built for decision makers who need insights, not just information.

If your responsibilities include reserves management, production forecasting, or upstream investment planning, consider the competitive advantage of having these capabilities at your fingertips.